- Home

- Product

- Integrations

- See All Integrations

-

Top Order Systems

Top Return Management Systems

Accounting Systems (ERP)

- Solutions

- Industries

- Resources

- Company

By

Brian Webb

October 8, 2025

~7 minutes

If your Amazon sales or fees seem to shift days after you’ve already booked them, you’re not imagining things.

Across the Blue Onion customer base, we’ve uncovered a widespread issue we call Amazon data drift — where sales, fees, and even cancellations continue changing for days after data is first pulled. And for most finance teams, this silent drift is breaking daily bookings, delaying monthly closes, and introducing inaccuracies into ERP systems.

Amazon data drift occurs when previously booked transaction data like sales, refunds, or fees gets retroactively updated by Amazon after the initial reporting date.

In our customer analyses, Amazon order and revenue data continues changing three or more days after the initial pull, creating inconsistent and unreliable financial reporting.

The kicker?

80% of companies don’t even know it’s happening.

Only about 20% of finance teams have identified and attempted to address it, often after spotting discrepancies between Amazon reports, ERP data, and bank settlements.

Amazon’s platform is incredibly dynamic and that’s part of the problem. Some of the most common triggers for post-fact data updates include:

These shifts cause previously reported data to “move,” meaning your Amazon sales and revenue reports can change even days after you’ve reconciled them.

The impact can be significant.

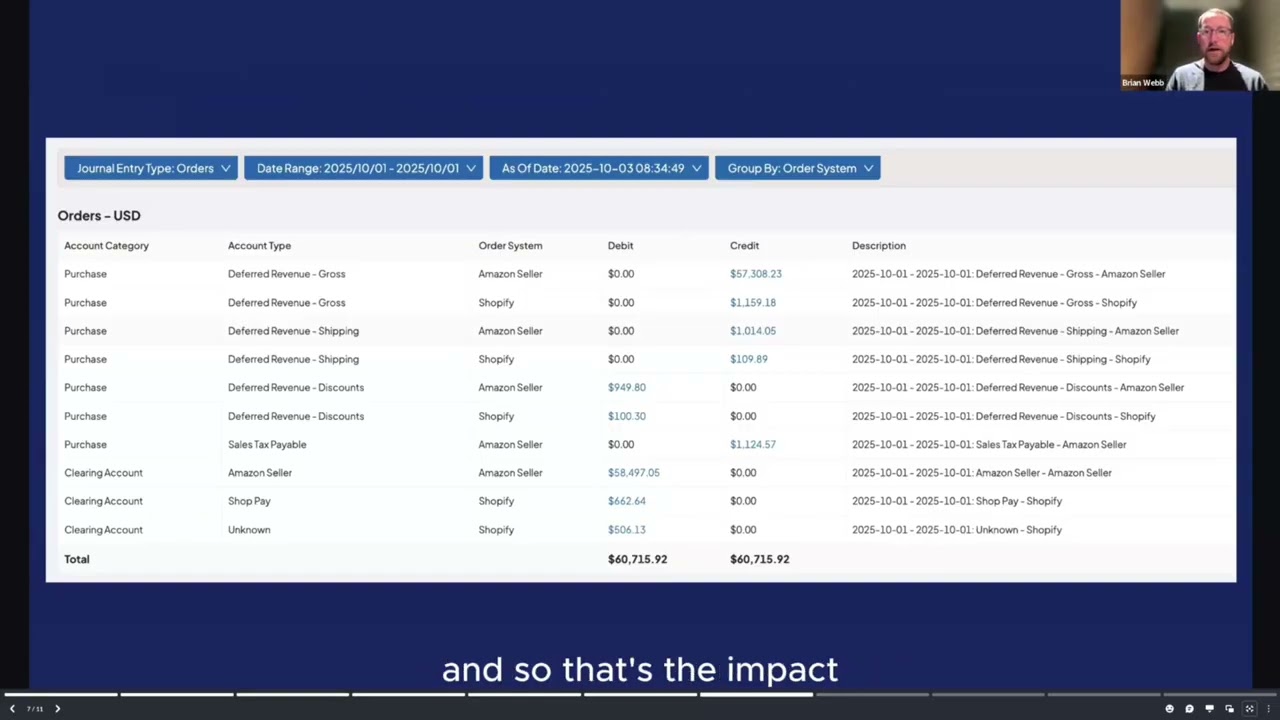

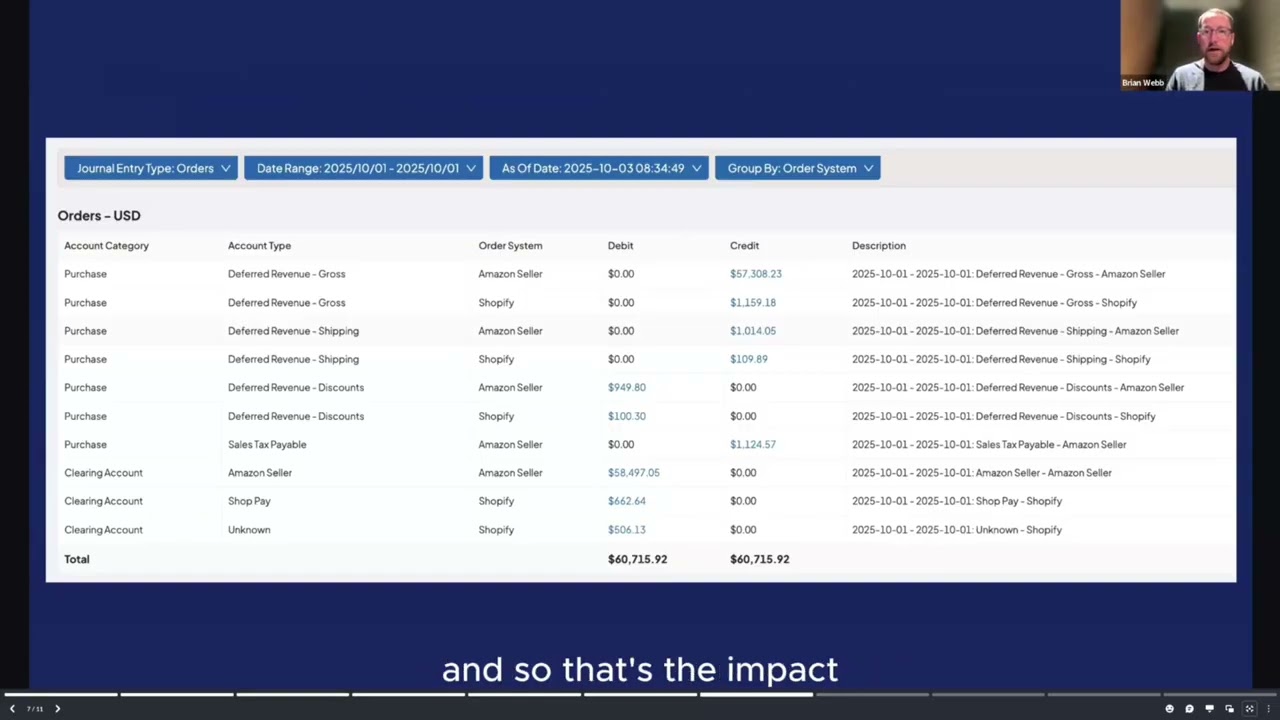

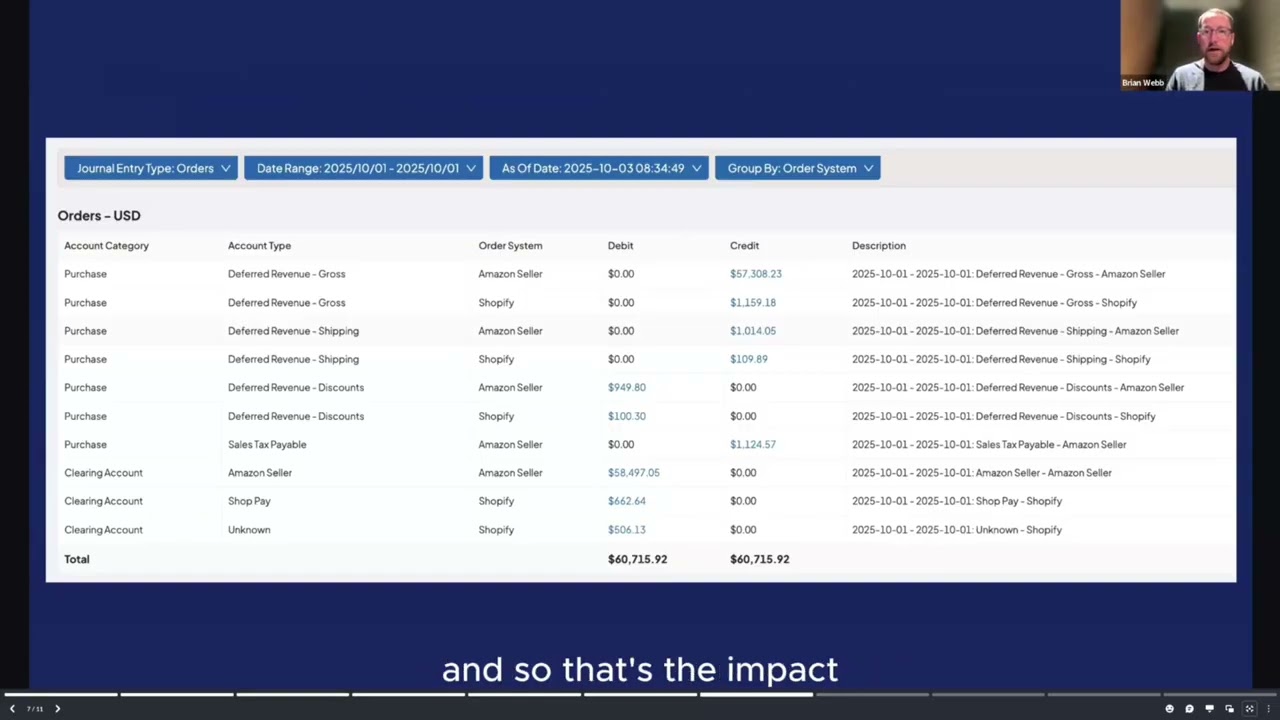

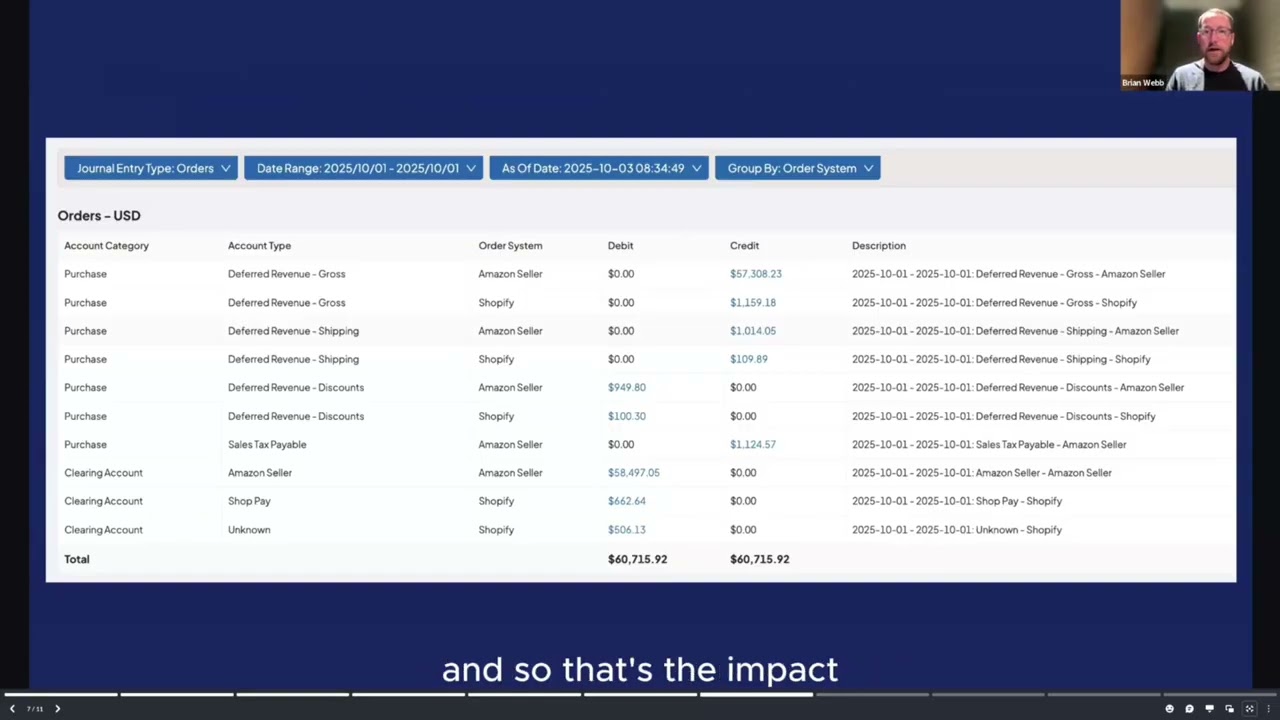

In one real-world customer example:

Revenue recognition followed a similar pattern:

For context, Shopify data during the same period remained stable, confirming this issue is Amazon-specific. PayPal data also shows similar drift tendencies, but Amazon remains the biggest culprit.

For finance teams booking daily, these delayed data changes mean yesterday’s numbers aren’t final and monthly closes can stretch weeks longer as teams chase accuracy.

Once teams realize what’s happening, the natural instinct is to “catch” the changes manually — often through:

While settlement reports are the only guaranteed complete view, they lag up to two weeks, forcing finance teams to choose between speed and accuracy.

Neither option scales and neither delivers real confidence.

Blue Onion’s approach is to automate away the uncertainty.

We’re developing a feature suite called Smart Adjustments, designed to make data drift visible and manageable directly within your accounting workflow.

Here’s what’s coming:

These updates are part of our broader mission to help finance teams move beyond manual reconciliation and achieve true financial accuracy even when source systems keep changing.

Data drift doesn’t just cause headaches; it undermines the core of financial reporting.

When your numbers move days after booking, you lose:

By exposing hidden data drift and automating the fix, Blue Onion ensures finance teams can focus on analysis, not cleanup.

During the webinar Q&A, one audience member asked whether Blue Onion plans to handle COGS (Cost of Goods Sold) within these workflows.

The answer?

Yes: COGS functionality is on the roadmap. While there’s no committed timeline yet, the Blue Onion team is actively exploring ways to automate COGS reconciliation alongside sales and revenue data, extending the same transparency and control to inventory-related costs.

Amazon’s constant data updates make “final numbers” a moving target. For most finance teams, that means endless rebookings, delayed closes, and reactive accounting.

Blue Onion gives you back control showing you what changed, when it changed, and why so your books stay accurate without the manual chaos.

Watch the full webinar replay or book a personalized demo to see how Blue Onion can give your team full visibility, audit readiness, and confidence in every number.

January 16, 2026

~2 minutes

Blue Onion Unveils Product Feature to Combat Data Drift

If you’ve never heard of "data drift," you’re not alone. Most teams don’t realize Amazon data isn’t static. Watch this short clip where Blue Onion breaks down what’s really happening behind the scenes and how Blue Onion helps you stay in control of your numbers.

January 16, 2026

~2 minutes

Blue Onion Unveils Product Feature to Combat Data Drift

If you’ve never heard of "data drift," you’re not alone. Most teams don’t realize Amazon data isn’t static. Watch this short clip where Blue Onion breaks down what’s really happening behind the scenes and how Blue Onion helps you stay in control of your numbers.

January 16, 2026

~2 minutes

Blue Onion Unveils Product Feature to Combat Data Drift

If you’ve never heard of "data drift," you’re not alone. Most teams don’t realize Amazon data isn’t static. Watch this short clip where Blue Onion breaks down what’s really happening behind the scenes and how Blue Onion helps you stay in control of your numbers.

January 16, 2026

~2 minutes

Blue Onion Unveils Product Feature to Combat Data Drift

If you’ve never heard of "data drift," you’re not alone. Most teams don’t realize Amazon data isn’t static. Watch this short clip where Blue Onion breaks down what’s really happening behind the scenes and how Blue Onion helps you stay in control of your numbers.

January 16, 2026

~2 minutes

Blue Onion Unveils Product Feature to Combat Data Drift

If you’ve never heard of "data drift," you’re not alone. Most teams don’t realize Amazon data isn’t static. Watch this short clip where Blue Onion breaks down what’s really happening behind the scenes and how Blue Onion helps you stay in control of your numbers.

January 16, 2026

~2 minutes

Blue Onion Unveils Product Feature to Combat Data Drift

If you’ve never heard of "data drift," you’re not alone. Most teams don’t realize Amazon data isn’t static. Watch this short clip where Blue Onion breaks down what’s really happening behind the scenes and how Blue Onion helps you stay in control of your numbers.

January 6, 2026

~3 minutes

How to Do More With Less in 2026: Why AI Investments Are Shifting From Promise to Proof

As we head into 2026, one mandate dominates finance and accounting teams: do more with less. Market uncertainty, hiring constraints, and tighter scrutiny on spending have fundamentally changed how leaders evaluate technology investments, especially AI.

January 6, 2026

~3 minutes

How to Do More With Less in 2026: Why AI Investments Are Shifting From Promise to Proof

As we head into 2026, one mandate dominates finance and accounting teams: do more with less. Market uncertainty, hiring constraints, and tighter scrutiny on spending have fundamentally changed how leaders evaluate technology investments, especially AI.

January 6, 2026

~3 minutes

How to Do More With Less in 2026: Why AI Investments Are Shifting From Promise to Proof

As we head into 2026, one mandate dominates finance and accounting teams: do more with less. Market uncertainty, hiring constraints, and tighter scrutiny on spending have fundamentally changed how leaders evaluate technology investments, especially AI.

January 6, 2026

~3 minutes

How to Do More With Less in 2026: Why AI Investments Are Shifting From Promise to Proof

As we head into 2026, one mandate dominates finance and accounting teams: do more with less. Market uncertainty, hiring constraints, and tighter scrutiny on spending have fundamentally changed how leaders evaluate technology investments, especially AI.

January 6, 2026

~3 minutes

How to Do More With Less in 2026: Why AI Investments Are Shifting From Promise to Proof

As we head into 2026, one mandate dominates finance and accounting teams: do more with less. Market uncertainty, hiring constraints, and tighter scrutiny on spending have fundamentally changed how leaders evaluate technology investments, especially AI.

January 6, 2026

~3 minutes

How to Do More With Less in 2026: Why AI Investments Are Shifting From Promise to Proof

As we head into 2026, one mandate dominates finance and accounting teams: do more with less. Market uncertainty, hiring constraints, and tighter scrutiny on spending have fundamentally changed how leaders evaluate technology investments, especially AI.

December 17, 2025

~43 Minutes

Turning Year-End Chaos Into Financial Clarity

Year-end doesn’t have to be stressful. In this webinar, we break down how clean, accurate monthly financials transform year-end close from a fire drill into a clear, confident process.

December 17, 2025

~43 Minutes

Turning Year-End Chaos Into Financial Clarity

.png)

.png)

Year-end doesn’t have to be stressful. In this webinar, we break down how clean, accurate monthly financials transform year-end close from a fire drill into a clear, confident process.

December 17, 2025

~43 Minutes

Turning Year-End Chaos Into Financial Clarity

.png)

.png)

Year-end doesn’t have to be stressful. In this webinar, we break down how clean, accurate monthly financials transform year-end close from a fire drill into a clear, confident process.

December 17, 2025

~43 Minutes

Turning Year-End Chaos Into Financial Clarity

Year-end doesn’t have to be stressful. In this webinar, we break down how clean, accurate monthly financials transform year-end close from a fire drill into a clear, confident process.

If your Amazon sales or fees seem to shift days after you’ve already booked them, you’re not imagining things.

Across the Blue Onion customer base, we’ve uncovered a widespread issue we call Amazon data drift — where sales, fees, and even cancellations continue changing for days after data is first pulled. And for most finance teams, this silent drift is breaking daily bookings, delaying monthly closes, and introducing inaccuracies into ERP systems.

Amazon data drift occurs when previously booked transaction data like sales, refunds, or fees gets retroactively updated by Amazon after the initial reporting date.

In our customer analyses, Amazon order and revenue data continues changing three or more days after the initial pull, creating inconsistent and unreliable financial reporting.

The kicker?

80% of companies don’t even know it’s happening.

Only about 20% of finance teams have identified and attempted to address it, often after spotting discrepancies between Amazon reports, ERP data, and bank settlements.

Amazon’s platform is incredibly dynamic and that’s part of the problem. Some of the most common triggers for post-fact data updates include:

These shifts cause previously reported data to “move,” meaning your Amazon sales and revenue reports can change even days after you’ve reconciled them.

The impact can be significant.

In one real-world customer example:

Revenue recognition followed a similar pattern:

For context, Shopify data during the same period remained stable, confirming this issue is Amazon-specific. PayPal data also shows similar drift tendencies, but Amazon remains the biggest culprit.

For finance teams booking daily, these delayed data changes mean yesterday’s numbers aren’t final and monthly closes can stretch weeks longer as teams chase accuracy.

Once teams realize what’s happening, the natural instinct is to “catch” the changes manually — often through:

While settlement reports are the only guaranteed complete view, they lag up to two weeks, forcing finance teams to choose between speed and accuracy.

Neither option scales and neither delivers real confidence.

Blue Onion’s approach is to automate away the uncertainty.

We’re developing a feature suite called Smart Adjustments, designed to make data drift visible and manageable directly within your accounting workflow.

Here’s what’s coming:

These updates are part of our broader mission to help finance teams move beyond manual reconciliation and achieve true financial accuracy even when source systems keep changing.

Data drift doesn’t just cause headaches; it undermines the core of financial reporting.

When your numbers move days after booking, you lose:

By exposing hidden data drift and automating the fix, Blue Onion ensures finance teams can focus on analysis, not cleanup.

During the webinar Q&A, one audience member asked whether Blue Onion plans to handle COGS (Cost of Goods Sold) within these workflows.

The answer?

Yes: COGS functionality is on the roadmap. While there’s no committed timeline yet, the Blue Onion team is actively exploring ways to automate COGS reconciliation alongside sales and revenue data, extending the same transparency and control to inventory-related costs.

Amazon’s constant data updates make “final numbers” a moving target. For most finance teams, that means endless rebookings, delayed closes, and reactive accounting.

Blue Onion gives you back control showing you what changed, when it changed, and why so your books stay accurate without the manual chaos.

Watch the full webinar replay or book a personalized demo to see how Blue Onion can give your team full visibility, audit readiness, and confidence in every number.